History of Innovation

History of Innovation

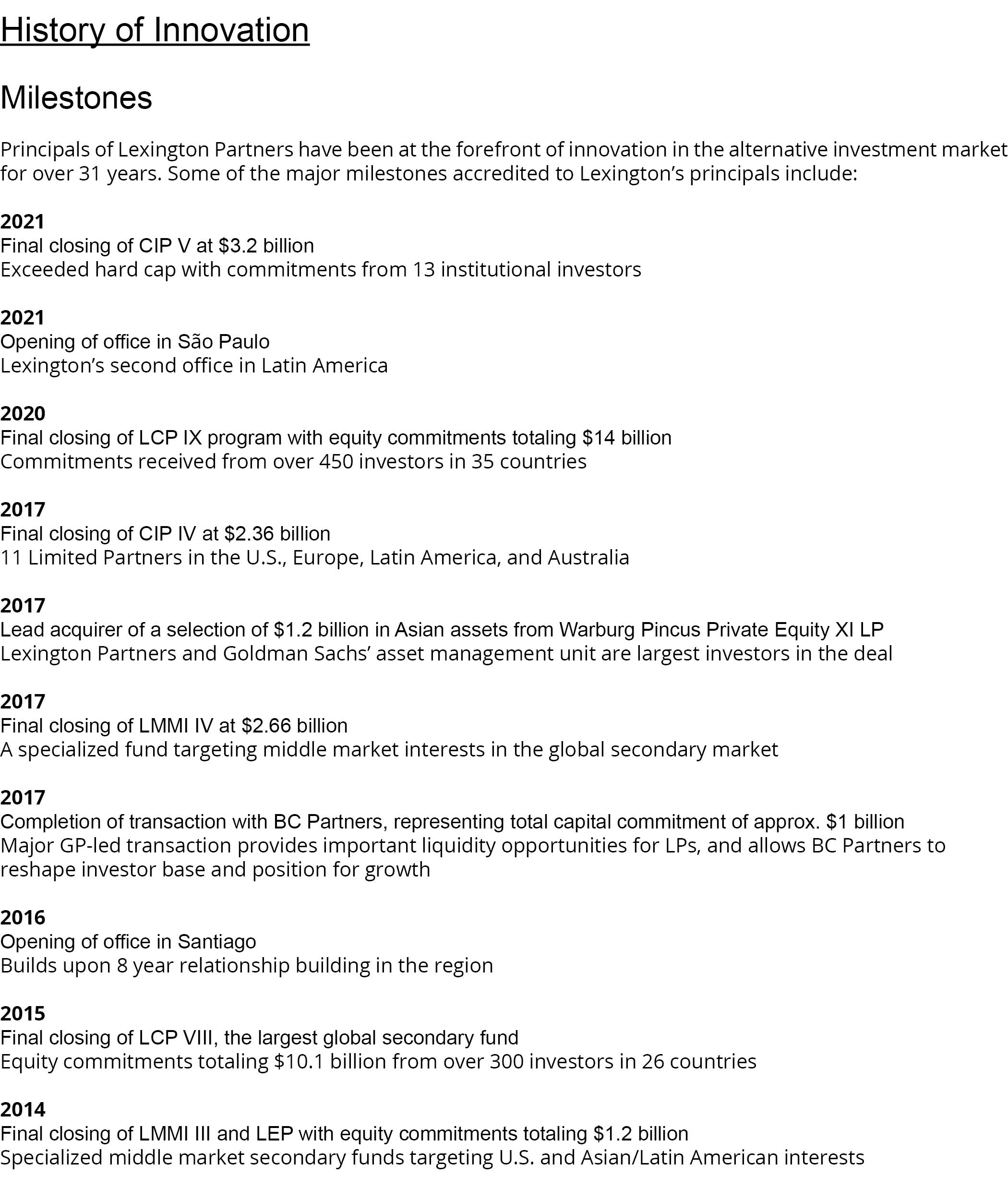

Milestones

Principals of Lexington Partners have been at the forefront of innovation in the alternative investment market for over 34 years. Some of the major milestones accredited to Lexington’s principals include:

2023 Final closing of LCP X program with commitments totaling $22.7 billion

Commitments received from over 400 direct investors in 45 countries

2022 Completion of transaction with large U.S. public pension, representing total capital commitment of approx. $3.1 billion

Major partnership transaction represents one of the largest deals in history of the secondary market with a seller that is a premier institutional private equity investor

Franklin Templeton Completes Acquisition of Lexington Partners

Transaction completed to provide continuity for Lexington’s highly experienced team and continued strong alignment with investors

Final Closing of CIP V at $3.2 billion

Exceeded hard cap with commitments from 13 institutional investors

Opening of office in São Paulo

Lexington’s second office in Latin America

2021 Opening of office in Luxembourg

Expanding Lexington’s European footprint

Final closing of LCP IX program with commitments totaling $14 billion

Commitments received from over 450 investors in 35 countries

Final closing of CIP IV at $2.36 billion

11 Limited Partners in the U.S., Europe, Latin America, and Australia

Final Closing of LMMI IV at $2.66 billion

A specialized fund targeting middle market interests in the global secondary market

Completion of transaction with leading European GP, representing total capital commitment of approx. $1 billion

Major GP-led transaction provides important liquidity opportunities for LPs, and allows GP to reshape investor base and position for growth

Opening of office in Santiago

Builds upon 8 year relationship building in the region

Final closing of LCP VIII, the largest global secondary fund at the time

Commitments totaling $10.1 billion from over 300 investors in 26 countries

Final closing of LMMI III and LEP with commitments totaling $1.2 billion

Specialized middle market secondary funds targeting U.S. and Asian/Latin American interests

Development of the infrastructure secondary market

Purchase of a $500 million original commitment to a leading global infrastructure fund from a U.S. bank

Final closing of CIP III, one of the largest dedicated global co-investment funds at the time

Commitments totaling $1.57 billion

Leadership of $1.7 billion secondary transaction

Purchase of portfolio of private equity and alternative investments from large institutional investor

Final closings of LMMI II and LCP VII, the largest global secondary fund at the time

Commitments totaling $7.65 billion from over 200 investors in 20 countries

Purchase of a diversified portfolio of co-investments, fund-of-funds and mezzanine investments from a U.S. bank

$1.2 billion purchase of 128 private equity interests

Purchase of a diversified portfolio of private equity interests from the largest U.S. public pension fund at the time

$1.5 billion purchase, as part of a syndicate, of 52 private equity fund interests

Expansion of Lexington’s successful co-investment program

Forming a dedicated fund to make equity co-investments in Europe and Asia (CIP Europe)

Leadership of a secondary spin-out transaction from a hedge fund

$200 million transaction to acquire a 70% stake in 19 investments

Expansion of Lexington’s innovative co-investment program to form CIP II

Adding a second leading U.S.-based institutional investor

Formation of a dedicated secondary fund to acquire middle market buyout interests (LMMI I)

Including those less than 50% funded at acquisition

Formation of a global secondary fund, LCP V, to acquire a diversified portfolio of private equity interests

Commitments totaling $2.0 billion

Purchase of a diversified portfolio of private equity interests from a corporate pension trust

$570 million purchase of 90 fund interests from a Fortune 500 company

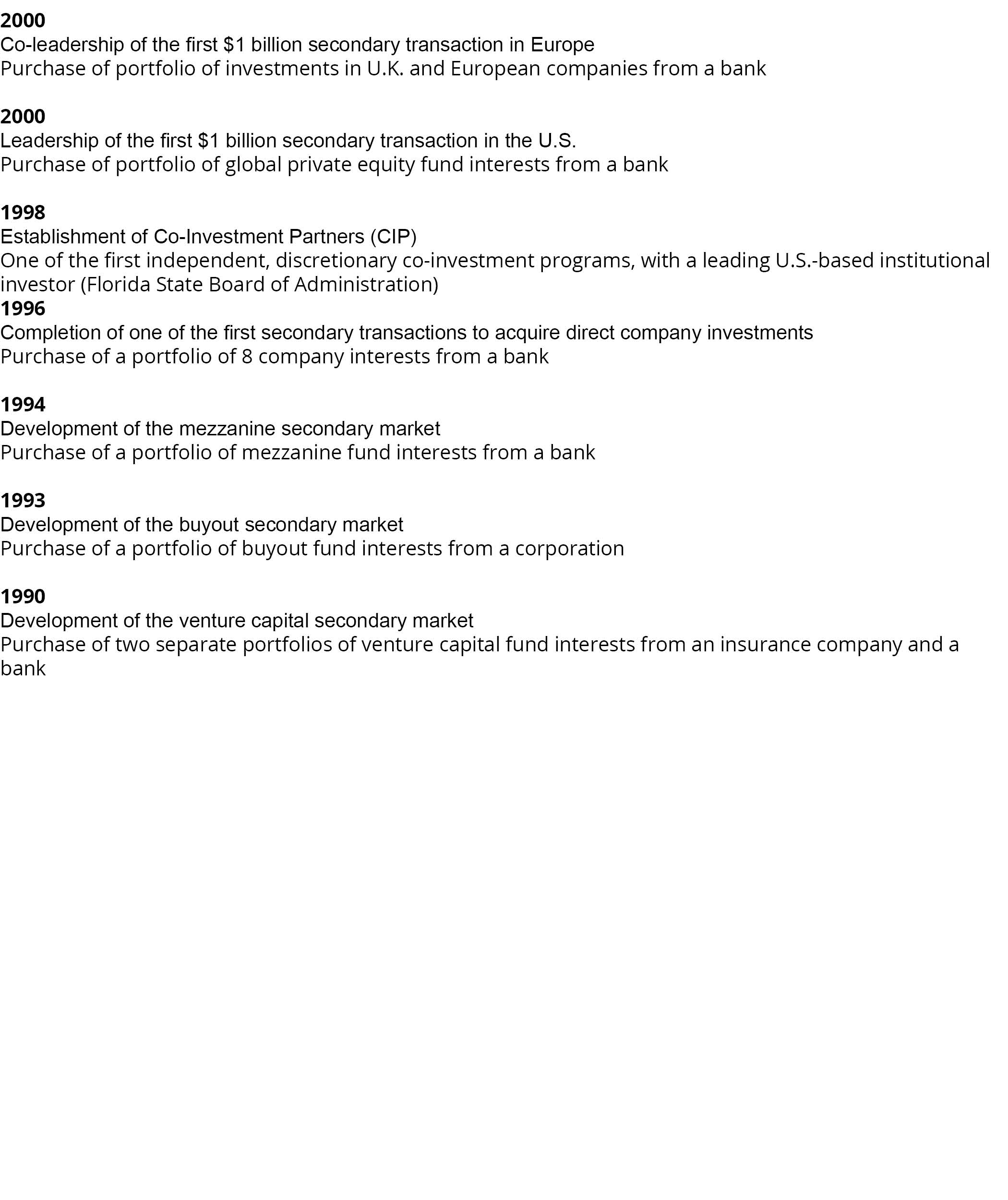

Co-leadership of the first $1 billion secondary transaction in Europe

Purchase of portfolio of investments in U.K. and European companies from a bank

Leadership of the first $1 billion secondary transaction in the U.S.

Purchase of portfolio of global private equity fund interests from a bank

Establishment of Co-Investment Partners (CIP)

One of the first independent, discretionary co-investment programs, with a leading U.S.-based institutional investor (Florida State Board of Administration)

Completion of one of the first secondary transactions to acquire direct company investments

Purchase of a portfolio of 8 company interests from a bank

Development of the mezzanine secondary market

Purchase of a portfolio of mezzanine fund interests from a bank

Development of the buyout secondary market

Purchase of a portfolio of buyout fund interests from a corporation

Development of the venture capital secondary market

Purchase of two separate portfolios of venture capital fund interests from an insurance company and a bank