Lexington Today

Lexington Today

An Industry Leader and Pioneer

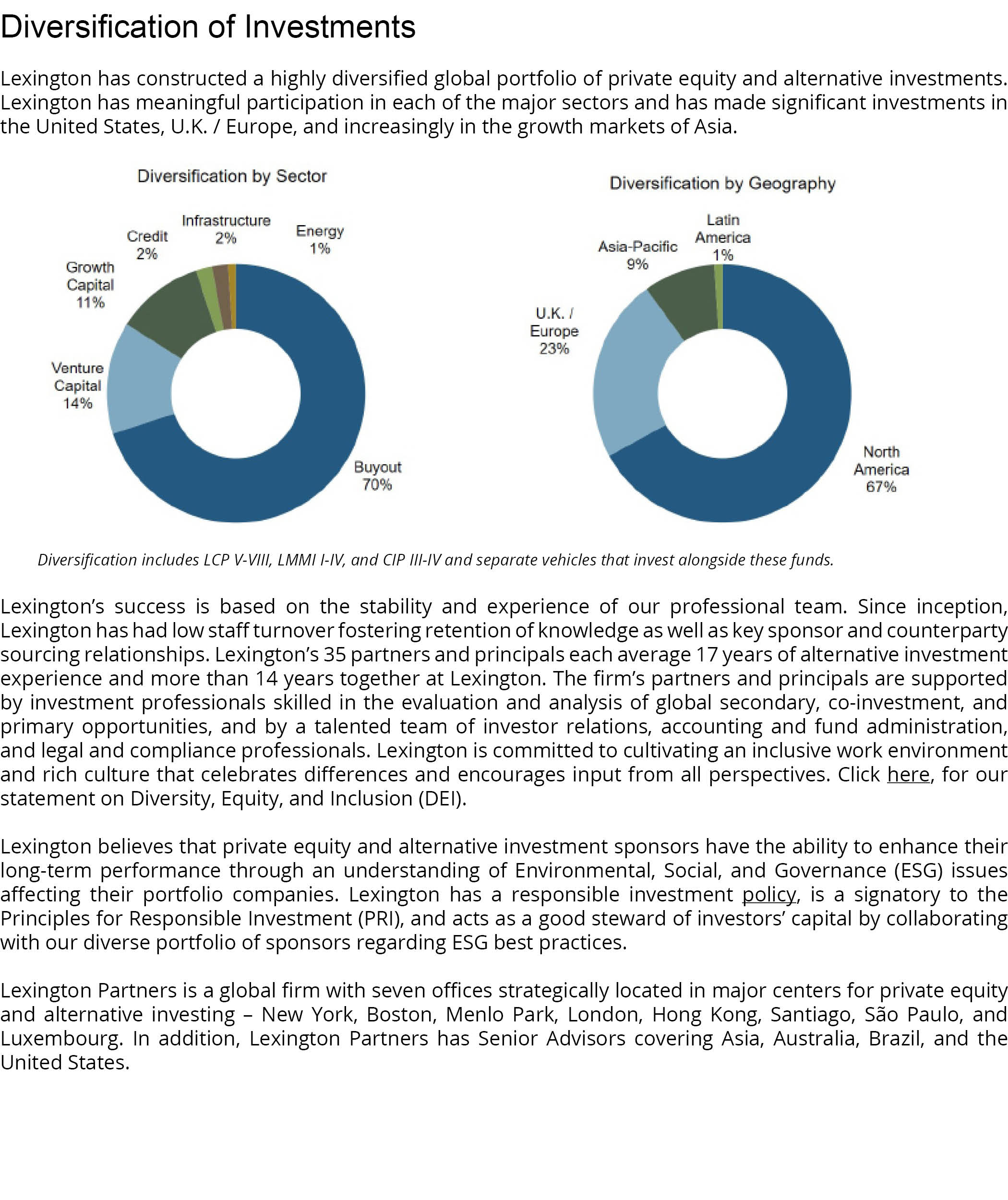

Lexington Partners helped pioneer the development of the institutional secondary market 34 years ago and created one of the first discretionary co-investment programs 26 years ago. Today, Lexington Partners has:

- Acquired over 4,000 secondary interests through more than 650 secondary transactions with a total value in excess of $72 billion, including $18 billion of syndicated transactions

- Invested $8.3 billion in over 500 co-investments alongside more than 180 sponsors

- Committed more than $3.0 billion to over 650 primary funds

Lexington’s success is based on the stability and experience of our professional team. Since inception, Lexington has had low senior turnover fostering retention of knowledge as well as key sponsor and counterparty sourcing relationships. Lexington’s 23 partners average 20 years of private equity experience and 18 years together at Lexington. The firm’s partners are supported by investment professionals skilled in the evaluation and analysis of global secondary, co-investment, and primary opportunities, and by a talented team of investor relations, accounting and fund administration, legal and compliance professionals, human resources and information and business technology professionals. Lexington is committed to cultivating an inclusive work environment and rich culture that celebrates differences and encourages input from all perspectives. Click here for our statement on Diversity, Equity, and Inclusion (DEI).

Lexington believes that private equity and alternative investment sponsors have the ability to enhance their long-term performance through an understanding of Environmental, Social, and Governance (ESG) issues affecting their portfolio companies. Lexington has an ESG and Stewardship policy, is a signatory to the Principles for Responsible Investment (PRI), and acts as a good steward of investors’ capital by collaborating with our diverse portfolio of sponsors regarding ESG best practices.

Lexington Partners is a global firm with eight offices strategically located in major centers for private equity and alternative investing – New York, Boston, Menlo Park, London, Hong Kong, Santiago, São Paulo, and Luxembourg. In addition, Lexington Partners has Senior Advisors supporting our professionals globally, including Asia and the United States.